How Vail Could Change VT

Updated March 7:

As news of Vail buying Stowe’s lifts and skiing operations circulated like wildfire, questions began popping up in bars, on Facebook and around the internet: “What does this mean?” “What’s next?” And, for Stowe skiers particularly, “where the %#*Q@%U will we park?” We had a chance to take a few runs and have lunch with Blaise Carrig, Vail’s representative in charge of the acquisition and transition. Here’s what we’ve learned:

1. Costs: Will We Pay More or Less?

Vail might be known for astronomical day ticket prices (the walk-up window price for age 13-64 is $189, versus $124 at Stowe), but its Epic Pass options have been a bargain and “Stowe will be part of the traditional Epic Pass offering for 2017/18,” says Carrig.

The early season rate for a 2017/18 Epic Pass is $859 (posted in March 7, 2017) compared to Stowe’s no-blackout December season pass price of $1,860. The Epic Pass allows unrestricted access to Vail, Beaver Creek, Breckenridge, Keystone and Arapahoe Basin in Colorado; Park City in Utah; Heavenly, Northstar and Kirkwood at Lake Tahoe; Canada’s Whistler/Blackcomb and Perisher in Australia for the 2017 season there; Afton Alps in Minnesota; Mt. Brighton in Michigan; Wilmot Mountain in Wisconsin are also included and Vail has stated it will “integrate Stowe into the Epic Pass” once the acquisition is final.

How will this affect pricing at other Vermont resorts? “It will be interesting to see how it plays out,” says Parker Riehle, president of the trade organization, Ski Vermont. “Does this mean that Sugarbush or Jay makes a move to get on the Mountain Collective pass?” he says, referring to the Epic Pass’ competitor, The Mountain Collective. This 201617 season, Stowe was part of the Mountain Collective which meant it bundled a season pass with discounts or free days at more than a dozen other resorts around the world, including Aspen, Jackson Hole and Chamonix.

“We also have a good array of pass products here in Vermont, particularly those geared around the millennial and under 34 population,” Riehle said.

Sugarbush, which has been a pioneer at segmenting its pass prices to meet various markets, plans to continue in that vein and announced on March 8 it would be part of The Mountain Collective. . “The Epic Pass is a one-pony act,” says Sugarbush CEO and owner Win Smith. “We have the Threesome Pass for college students [which includes Mad River Glen as well as Sugarbush’s Lincoln Peak and Mount Ellen], our For20 pass, our Boomer Pass and kids ski free with an adult.” The Sugarbush For20 pass, for instance, was $469 for those under 30 and those under 35 paid $699, versus the regular season pass price of $1779.

Jay Peak spokesperson J.J. Tolland did not seem particularly concerned: “Our early season pass prices are already lower than the Epic Pass price so I don’t see it being a factor,” said Tolland. Jay’s season pass prices ranged from $749 for 30-64 if bought by July 11, 2016, to $1149). “We just came off our busiest day ever,” said Tolland, referring to the President’s Day Saturday. “We have 351 inches of snow and if everything holds steady, we’re on track to be ahead of forecast for this season. We think the Vail buy is great for Vermont. If anything, it’s going to activate skiers throughout New England and elevate the profile of our sport across the board.”

In early March resorts around the state started to announce early season deals. Bolton Valley’s Value 7 pass is $489, if you buy before April 3. Mount Snow announced on March 3 that its Peak Pass (good at seven ski areas around New England) is $599 for adults, if purchased by April 30. At the Middlebury Snow Bowl if you buy a 2017/18 pass you ski for free in March. Both Mount Snow’s and Bolton’s passes are about $100 cheaper than they were last September

The upshot: The cost of a season pass at Stowe is most likely going to come down. It may bring prices at surrounding resorts down as well—though each resort has so many current options and price ranges that it’s hard to say how much will change.

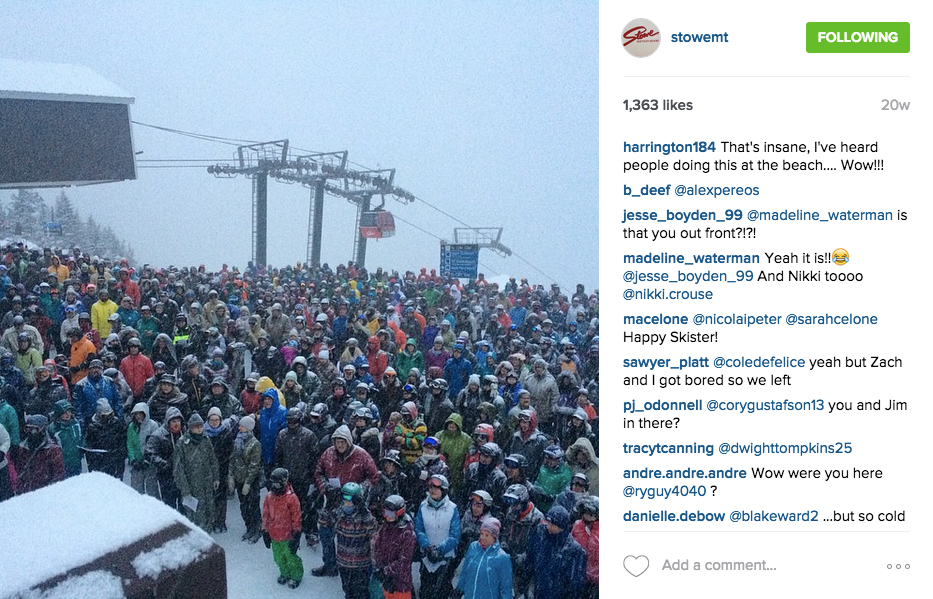

2. Crowds: How Much More Crowded Can It Get?

In a survey by VT Ski+Ride, 65 percent of respondents felt the purchase would be a good thing for Vermont’s skiers and riders. Nearly 81 percent thought it would bring the price of a season pass down. And 75 percent thought that lift lines and parking would take longer.

“It’s great that a world-class mountain resort company chose Vermont and we are going to see a lot more people coming here to ski,” says Riehle, adding, “Vail sells more Epic Passes in a year than there are people in Vermont.” That’s 650,000, in fact, but across 13 resorts, including Perisher in Australia, Whistler/Blackcomb, Northstar-at-Tahoe, Kirkwood and others.

Sugarbush’s owner and CEO Win Smith echoed that sentiment: “Vail has said it wants to sell a million Epic Passes. Vail is hoping to expand in Japan and I wouldn’t be surprised if we see them buy in Europe too. It has a tremendous marketing power and I think you are going to see people coming here from all over the world. I would not underestimate Vail Resorts and Rob Katz, their CEO, is a smart guy.”

For Vermont, as a whole, the added marketing firepower could be a good thing. “I was teaching at Stowe on Tuesday and you could ski right up to the quad, on a holiday week, with no lines,” says Jeff Teplitz, a part-time ski instructor at Stowe. “Yes, it’s crowded on weekends, but weekdays are usually pretty empty.”

Recent weekends, however, have seen in excess of 9,000 people using the Stowe lifts, often leaving long lines and congested traffic. Stowe’s stated uphill capacity is 15,516 skiers per hour. By comparison, Sugarbush has a 21,000 capacity per hour and Killington has a lift capacity of 37,535 per hour.

“If Stowe cuts its season pass price in half, I would worry you might see the place overrun,” notes Rob Megnin, marketing director of Killington. “It’s not just about how many people you can put on chairs in the air, but where the skiers go. When the woods are open—and here at Killington we have a broad open “Natural Woods Policy’ that relieves a lot of the congestion on trails—that helps, but if you’re limited to trails, it can get crowded.” Killington also saw record numbers of skiers or riders over the President’s Day weekend, as did a number of other resorts around the state.

Net: More people are likely to be skiing and visiting Stowe… and other places around Vermont.

3. Traffic: Where Will People Park?

This past holiday season, Stowe Mountain Resort had to issue apologies to skiers and riders who could not find parking spaces. Traffic has been routinely backed miles down the Mountain Road on weekends and the fact that Spruce Peak Resort parking is now reserved for guests only, doesn’t help matters

For those worried that Vail’s purchase will bring crowds, Blaise Carrig is the guy to set your mind at ease—at least he did so as we took a few runs in late February. Carrig, 65, started out what he calls his “career as a ski bum,” in 1976 as a ski patroller at Sugarbush and worked his way up to become managing director there. Since 2002, he’s worked for Vail Resorts and ran Vail (the ski mountain) from 2008-2014.

Carrig is now overseeing acquisitions. “We don’t want our resorts to all be the same,” Carrig assured me. He promises the first thing Vail will address is the parking and traffic situation, which has been a problem on busy weekends this season.

The Spruce Peak complex already has a 300- to 400-car parking garage on its Act 250 plan, which could repatriate some of the parking that spilled onto the Mt. Mansfield side. Vail also hopes to expand parking around the Mt. Mansfield base and at the Nordic center. “I don’t think you are going to see things get too much more crowded,” Carrig said. He also noted that Stowe would have the EpicMix app, which crowdsources skier locations to let you know about lift lines and traffic. It also provides snow condition updates, tracks your vertical, has a photo function and can share your location.

Another solution which Carrig hopes won’t go into effect at Stowe: paid parking. Parking at the covered Lions Head and Vail Village parking structures is $25 for 4 or more hours. Or you can buy a season pass which starts at $1,100 (for employees of the resort or local business and property owners) with blackout dates. Season pass parking goes as high as $3,250 with no blackout dates.

There are also options in Stowe for off-site lots and shuttle buses, but both would require permitting from the town.

Air traffic may also become an issue as well. Stowe’s expanded airport operator, Stowe Aviation, has already seen a significant uptick in traffic this season, from both the regularly scheduled Tradewind Aviation commercial flights from Westchester, NY and from private planes.

“It was crazy over Martin LutherKing Day weekend and President’s Day weekend; there were jets lined up on the runway waiting for takeoff or circling and waiting to land. Three years ago, the runway wasn’t even plowed at this time of year. We had 33 jets arrive this past weekend,” said Stowe Aviation founder Russell Barr. Barr expects that number to increase as Vail Resorts has a partnership with XOJet, allowing its Vail/Beaver Creek Signature Club members preferred rates with XOJet and on-demand access to more than 1,000 private jets.

The upshot: Parking will continue to be a problem on busy days and holidays, a problem that Vail and the town of Stowe will need to address.

4. Development: Does This Mean More Condos?

“Vail’s business strategy is less focused on real estate and development than it is on selling lift tickets and all the ancillary services that go along with skiing and riding—they buy up the area ski shops, food and beverage and hotels, if they can,” notes Win Smith, who was a senior Wall Street executive with Merrill Lynch before buying Sugarbush.

The Stowe purchase does not include lodging or real estate and is limited to the lifts, ski trails, land and leased land they occupy and the core resort operations. Vail’s purchase, said spokesperson Kelly Ladyga, “includes the Nordic Center and a lease on the Toll House base operations.” It also includes the new Spruce Peak Adventure Center and Spruce Camp base lodge. It does not include Spruce Peak’s hotel, conference and concert space, condos, townhomes or the two Stowe-owned golf courses (on the mountain and the Stowe Country Club, in town.) And AIG retains the rights to develop the Toll House base area.

The upshot: Vail’s deal does not currently include real estate so it will be limited in what additional development it can do at the mountain.

5. Employment: Will People Lose Their Jobs?

Vail’s press release stated that “we will be retaining the vast majority of the resort’s year-round staff. Future summer and winter season hiring will continue in the ordinary course.” According to Alyssa Noel, editor of The Whistler Question, “Vail said something similar to Whistler/Blackcomb employees when they acquired our resort last August. Then, in November 2016 they announced 60 layoffs.” The 60 layoffs, out of a total staff of 4,100 were primarily in IT and marketing, according to Noel. “These were high paying jobs so they were really felt across the community,” she said.

The upshot: with AIG and the Mount Mansfield Company retaining so much of the guest infrastructure, and Stowe being a smaller operation than W/B, there may be less of a chance of significant layoffs.

6. Other resorts: Who’s next?

When asked if Vail had talked to or approached other resorts, there had been a resounding “no” from Smuggler’s Notch, Sugarbush and Jay Peak. Tolland said that while Jay Peak and Burke Mountain (both of which are in receivership, following an EB-5 financing fraud scandal) are on the block, no immediate plans were in place for a sale.

“We’re not for sale,” Sugarbush’s Win Smith said emphatically. “I came to love the Mad River valley when my kids learned to ski here. I don’t think I would have bought another resort. It was worth that extra hour drive to get here because there was something special about the valley, the unpretentious nature of it, the really interesting people and sense of community that brought me here from New York. Bill Stritzler (of Smuggler’s Notch) and I are some of the last two ski resort owner/operators and I’m not planning on selling. I love it here.”

Still, during a later call in late February Smuggler’s Notch’s communication director Mike Chait said, “While we’re not actively for sale, we’d certainly be open to talking.” He noted that the resort might also be willing to reinstate an old policy that allowed skiers to traverse between the two resorts and use their pass for one lift ride up the other side.

When I asked Carrig about this, he just smiled. “Well, that’s interesting,” he said. “I owe Bill (Stritzler) a call.”

An earlier version of this article mistakenly stated that the Sugarbush Threesome Pass included Bolton Valley. It does not.