Epic v.s. Ikon: How the Pass Wars Began

Vail Resorts now owns Stowe, Okemo and Mount Snow in Vermont, along with 34 other resorts. Alterra Mountain Company owns Stratton Mountain and 13 others across North America. On Nov. 13, Alterra Mountain Company announced it has entered into an agreement to purchase Sugarbush Resort in a deal expected to close in Jan. 2019. Who are the leaders behind Alterra Mountain Company and Vail Resorts and how did the two companies rise to ascendancy?

The Vail Resorts Strategy

Vail Resorts started its acquisition game by becoming the owner of some of North America’s most iconic ski areas, purchasing Breckenridge and Keystone in 1996 and Heavenly in 2002. The company then began acquiring “feeder” mountains near urban areas such as Afton Alps in Minnesota and Mount Brighton in Michigan in 2012.

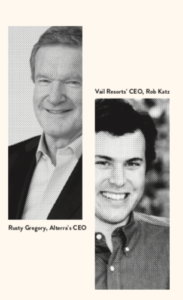

Much of the growth spree can be attributed to Rob Katz. Katz started out working in private equity in Manhattan and started covering Vail as an analyst at Apollo Management, LLP in 1991. He served on the company’s board from 1996 until 2006, when he became the company’s CEO. Vail Resorts announced the first Epic Pass in March 2008, featuring unlimited skiing at five resorts for $579.

Under Katz’s leadership, Vail Resorts has made skiing a luxury experience. Ron Baron, CEO and founder of Baron Funds started investing in Vail Resorts stock when the company went public in 1997. “At the time, they were charging $44 a day to ski at the mountain and we thought that if you made the experience better, instead of $44, you could charge $100.” When Katz took over in 2006, he did just that. “[He started] investing in the town, investing in the mountain… then he made ski passes a really huge part of the business and built a network of other mountains… and that ski pass business represents a very large percentage of the company’s cash flow,” Baron told CNBC’s Squawk Box in 2017.

In 2017, lift tickets accounted for 44 percent of revenue. Katz brought in data collection and better pass technology, revolutionizing the way it tracks customers and generating instant marketing data. In the last six years, Vail Resorts has invested more than $600 million in capital improvements across its resorts and now employs more than 30,000 people.

That has led to financial success: In March 2008, just before the Epic Pass was released, Vail Resorts’ stock price was listed at $45. In January, 2017, it was at $170. In early September, 2018, it hit $300. Shortly after the company that would become Alterra formed, Katz told CNBC’s “Squawk Box” that he hoped they would create a pass to rival the Epic Pass. “If they come in and offer something truly innovative, truly compelling, it’ll be a positive for the industry overall,” Katz said. Alterra did just that.

Note: On Wednesday, July 24, 2019, just two days after Vail Resorts announced it had entered into a definitive agreement to acquire 100 percent of outstanding stock in Peak Resorts, the only other publicly held American ski company, its stock price was listed at $245.51. For more about that deal, which is expected to close in fall 2019 and includes 16 ski areas, most of which are considered “feeder resorts” due to their close proximity to major American cities, see “Why Vail is Buying Mount Snow and 16 Other Ski Areas.”

The Alterra Mountain Company Way

April 2017 saw the birth of the company that would become Alterra. KSL Capital, a private equity group comprised of several former executives of Vail Resorts, teamed up with Henry Crown & Company, owner of Aspen Skiing Company and a significant stockholder in JP Morgan Chase and Hilton Hotels among other national corporations, to acquire Intrawest Resorts, Mammoth Resorts and Squaw Valley Ski Holdings for $1.5 billion. Between April 2017 and September, 2018, some of the biggest resorts in the nation were brought together under one operating company (which didn’t receive its name, Alterra Mountain Company, until January 2018). It now includes 13 resorts (Vermont’s Stratton, California’s Squaw Valley-Alpine Meadows and Mammoth Mountain;  Steamboat and Winter Park, Colo.; Deer Valley, Utah and, as of September, Crystal Mountain in Washington) as well as Canadian Mountain Holidays’ heli-skiing and hiking lodges. In March 2018, Alterra unveiled a plan to invest $550 million in capital improvements across its mountain resorts over the next five years.

Steamboat and Winter Park, Colo.; Deer Valley, Utah and, as of September, Crystal Mountain in Washington) as well as Canadian Mountain Holidays’ heli-skiing and hiking lodges. In March 2018, Alterra unveiled a plan to invest $550 million in capital improvements across its mountain resorts over the next five years.

Just two weeks after announcing the name Alterra, the company launched the Ikon Pass ($999), which is good at its resorts and 22 others. Rusty Gregory, Alterra’s CEO, will be the first to say that Alterra Mountain Company intends to be the industry counterpart to Vail Resorts. “Rob Katz is a good friend of mine,” says Gregory. “He and Vail have done an incredible job with their business model, which is highly centralized and efficient. The opportunity for Alterra is different, opposite in many ways. Our goal is to really create a company that supports the unique, individual, radically idiosyncratic personalities of the resorts that are part of the Ikon Pass.”

He calls Alterra Mountain Company a “house of brands and not a branded house.”

Gregory said that a variety of economic factors have made rapid consolidation a trend across industries in North America. “Financial markets are incredibly liquid and interest rates are low,” said Gregory in Fall 2018. But he says that environment won’t last forever. And when it changes, the rate of acquisitions will slow down.

For more from Rusty Gregory and Sugarbush owner Win Smith on the mountain’s sale, see “Inside Sugarbush’s Sale.”

Photo Caption: One of the many things that make Stowe Mountain Resort iconic is its red gondola system. The ski area has been a Vail Resort since 2017. Photo by David Braaten.

This story was last updated Nov. 20, 2019.